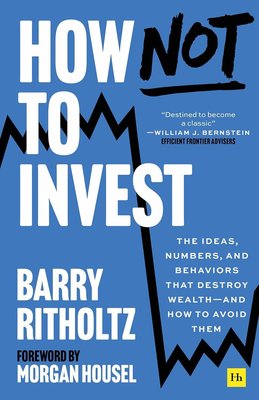

This book was designed to reduce mistakes. Your mistakes with money. Tiny errors, epic fails and everything in between. You can do thousands of things right, but make just a few of the errors we discuss, and you destroy much of your portfolio. If you could learn how to avoid the unforced errors investors make all the time, you would make your life so much richer and less stressful. The counterintuitive truth is avoiding errors is much more important than scoring wins. How Not To Invest shows you a few simple tools and models that will help you avoid the most common mistakes people make with their money. Learn these, and you are ahead of 98% of your peers. Make fewer errors, end up with more money. How Not To Invest lays out the most common errors investors make. Barry Ritholtz reveals his favorite mistakes, including the lessons we can learn from some of the wealthiest and most error-prone investors. We all make mistakes. The goal with this book is to help you make fewer of them, and to have the mistakes you do make be less expensive.